Bitcoin (BTC) has seen a recent pullback, dropping to the $68,000 range after lingering near $70,000. As of now, BTC trades at $69,100, reflecting a notable decline.

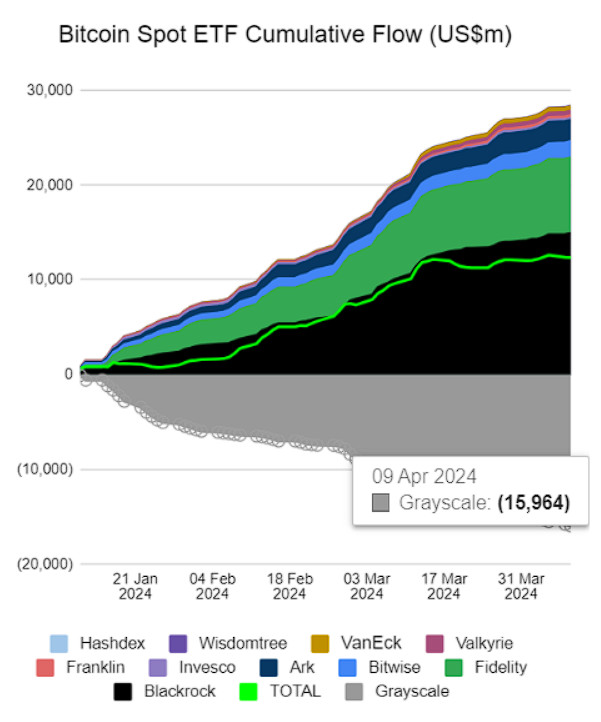

This downward movement coincides with two consecutive days of negative outflows from US-traded spot Bitcoin exchange-traded funds (ETFs), signaling investor caution.

Spot Bitcoin ETFs Witness $242.4 Million Outflow

According to Farside data, the outflows from US spot Bitcoin ETFs totaled $223.8 million on April 8, 2024, and $18.6 million on April 9, 2024. The Grayscale Bitcoin Trust (GBTC) was the primary contributor to these outflows, with a staggering $458.2 million lost over two days.

Market Eyes on CPI Data

Market sentiment is also being shaped by macroeconomic factors. The release of the US Consumer Price Index (CPI) data for March 2024 is eagerly awaited, with the median estimate for the year-over-year CPI at 3.4%. This would mark the largest annual increase since December 2023, indicating significant inflationary pressures.

Hong Kong ETFs Bring Optimism

On a brighter note, the Asian market brings some optimism. Tencent News reports that Hong Kong is set to announce its first four spot Bitcoin ETFs on April 15, with the Hong Kong Stock Exchange gearing up for their debut. However, the Securities and Futures Commission (SFC) of Hong Kong has yet to officially confirm this news.

Despite the lack of immediate impact on Bitcoin’s price, the introduction of spot Bitcoin ETFs in Hong Kong could serve as a long-term growth driver, encouraging greater Bitcoin demand.

Insight on Bitcoin’s Demand Dynamics

Previous reports by BeInCrypto and CryptoQuant analysts have highlighted the potential for post-halving price rallies, driven by increased Bitcoin demand, especially from whales. Notably, the demand from long-term holders now surpasses new issuance for the first time in history, suggesting a positive outlook for Bitcoin’s value.