Polygon is recognized as one of the most popular crypto projects today, primarily due to its team’s innovative approach to a critical issue faced by every popular blockchain—scalability. This article explores what scalability entails, outlines Polygon’s core mission, and explains why investing in the project’s cryptocurrency might be worthwhile.

Understanding Polygon

Polygon is a Layer 2 (L2) network solution. This term might sound a bit complex, but let’s break it down to understand how Polygon functions and why it is essential.

Everyone is familiar with the primary feature and innovation of cryptocurrencies—blockchain technology. This data storage technology involves chaining transaction records together into blocks, each linked to the next and the previous, forming a continuous chain.

When the number of transactions becomes too high, thus increasing the volume of records to be added to the blockchain, developers face a scalability issue: the system cannot expand fast enough to balance supply and demand, requiring assistance.

This is why multiple layers or levels of blockchain technology exist:

🏅 Level 0 (L0) — This is the foundational protocol (set of rules) upon which first-level solutions—complete blockchain projects—can be built.

🥇 First Level Solution (L1), or a primary blockchain. This is where familiar, finished blockchain projects like Bitcoin and Ethereum are situated.

🥈 Second Level Solution (L2) — An extension built on top of a first-level blockchain. L2 solutions are designed to alleviate the load on any cryptocurrency’s main network by taking on some of that load. For instance, they can handle transaction processing off the main chain.

L2 solutions address the problem of scalability—the system’s inability to handle increased loads and reduced efficiency. L2 enhances the performance of L1 networks and reduces overall transaction fees by offloading some of the burdens.

🥉 There is also a Third Level Solution (L3) — an overlay on top of L2, which can take on part of the load when even the L2 solution is insufficient.

With this foundation, we can dive into the specifics without missing anything important.

Polygon (formerly known as Matic Network until February 2021) operates as a Layer 2 network. It also includes a network of autonomous sidechains, which differ from L2 solutions in that they are not merely extensions but separate branches of the main blockchain. Here’s how they differ:

🖇 Sidechain — A branch off the main blockchain that, like L2 solutions, can handle part of the load. Unlike L2, a sidechain is a part of the main block chain. The main drawback of sidechains is their lower security level due to an inability to ensure adequate decentralization.

📎📎 Layer 2 Solution — A separate blockchain chain with its own rules, existing independently from L1.

The team behind Polygon believes that it can solve the scalability issues of blockchain networks and enhance their efficiency.

The project was launched in October 2017 by a group of 10 developers, including Sandeep Nailwal, Jaynti Kanani, Anurag Arjun, and Mihailo Bjelic, with significant partnerships over the years including MasterCard and Flipkart.

Resources: Official website, YouTube, Twitter, GitHub, Telegram, Reddit.

Moreover, Polygon has its cryptocurrency, MATIC, which we will discuss at the end of this article.

Supporting Ethereum

Polygon’s main task is to reduce the load on Ethereum’s blockchain, the second largest cryptocurrency by market capitalization. Remember, in September 2022, Ethereum underwent «the Merge» transitioning from the energy-intensive Proof-of-Work (PoW) to the more environmentally friendly Proof-of-Stake (PoS). This transition was a step towards enhancing Ethereum’s scalability (although that’s not the only purpose of the Merge, it’s the most relevant aspect for us now).

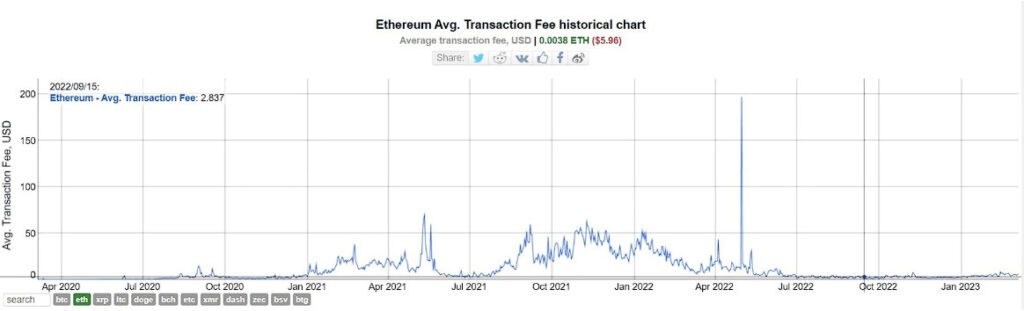

Due to the limitations of the PoW network, Ethereum was unable to process the required volume of transactions, leading to queues forming as users waited to conduct operations. Those willing to «jump the queue» could pay a higher fee, which led to a rapid increase in overall network fees in ETH.

With the shift to the more efficient Proof of Stake (PoS), developers have managed to enhance the scalability of Ethereum. Unfortunately, even after transitioning to a different algorithm, the transaction speed on the cryptocurrency network has remained insufficiently high. Solutions like those offered by Polygon continue to compensate for Ethereum’s shortcomings.

As a Layer 2 (L2) solution, Polygon cannot exist without Ethereum—it was created to improve it. That’s why Polygon is not considered a competitor to ETH. Ethereum can operate without overlays, but Layer 2 solutions would not be viable without L1’s challenges.

Polygon Ecosystem

As of early March 2023, the Polygon ecosystem includes several developments:

⛓ The Ethereum-compatible sidechain, Polygon PoS, supports a wallet, staking system, and other Polygon tools. This sidechain facilitates transactions on the Ethereum network, bypassing the problems of the L1 network—high fees and low speed. On Polygon PoS, for example, one can launch a decentralized application: technically, it operates on Ethereum, but the load is handled by Polygon.

👬 The Polygon zkEVM (an emulator or alternative copy of the Ethereum virtual machine) launched its testnet in October 2022. Built on ZK-Rollups technology, it allows network users to maintain anonymity, as transaction processing does not require personal information. Polygon zkEVM hosts a bridge for transferring assets between Ethereum and Polygon networks and a network explorer—a platform where you can view the project network’s metrics, information about transactions, and cryptocurrency wallet addresses.

Polygon zkEVM can be considered Ethereum’s twin—it replicates ETH’s operational principles but includes enhancements such as ZK-Rollups and can perform computations offline. The launch of the main network’s beta version for Polygon zkEVM is scheduled for March 27, 2023.

💪 Polygon Miden aims to enhance the scalability, security, and confidentiality of Polygon.

🪄 Additionally, Polygon offers a platform for creating proprietary blockchains and an identification system for the third generation of the internet (web3).

Many major companies use Polygon’s tools. For example, Starbucks chose Polygon for deploying its web3 loyalty program, and Warner Music Group launched a music NFT platform based on the startup’s tools.

Project Statistics

The popularity of Polygon can be gauged by the volume of locked funds. The term «locking» implies the intentional retention of assets within the project’s network, which occurs when another project, such as Ethereum, transfers assets to Polygon.

The peak popularity of the Polygon ecosystem occurred in mid-June 2021, during which the largest volume of assets was locked—$9.89 billion. For comparison, at the time of writing this review, the figure has dropped to $1.12 billion.

Here’s a look at the top 10 largest projects on Polygon, ranked by the volume of funds locked within the ecosystem:

Despite a decline in activity, the project continues to closely match Ethereum in terms of the number of active addresses: 363,229 for ETH versus 362,992 for Polygon.

In the overall ranking of blockchain projects, Polygon is in fourth place, trailing only behind Ethereum, Bitcoin, and the blockchain of the largest cryptocurrency exchange, BNB Chain.

Polygon Cryptocurrency

Polygon has a native token called MATIC, which is essential for conducting transactions within the project’s ecosystem and for paying transaction fees. MATIC also serves as a governance token. Here’s the key information about the coin:

💰 Release Stages: MATIC sales began in 2017 through private rounds. By 2019, the team had raised $5.6 million from cryptocurrency sales. The remaining coins were distributed according to the tokenomics plan by December 2022.

🪙 Issuance: The supply is limited. A total of 10,000,000,000 coins have been issued.

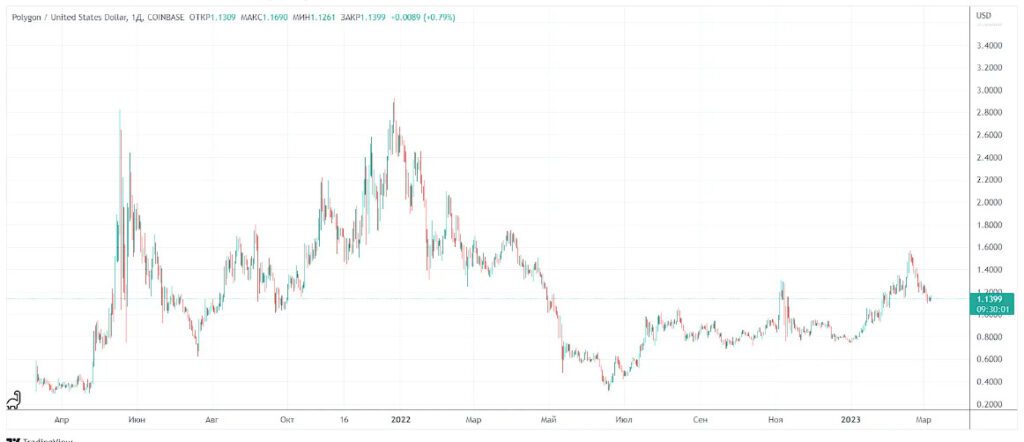

📈 Value: The all-time high for MATIC was on December 21, 2021, when the coin reached $2.92. As of the time of writing this overview, it is trading at around $1.

Polygon Cryptocurrency has consistently maintained its position in the top-10 most capitalized coins over an extended period.

Polygon Solutions in Demand

Polygon is in high demand with established partnerships with major companies and a large volume of active users. Its cryptocurrency, MATIC, consistently ranks among the top-10 most capitalized coins on the market.

Polygon has proven its effectiveness and earned a reputation within the crypto community. It is likely that the project will continue to develop due to the ongoing market need for scaling popular blockchains. This suggests that MATIC could be considered a viable investment option. MATIC is available for purchase on platforms like Binance and Bybit.