Sui is a high-performance, scalable Layer-1 blockchain built on the Proof-of-Stake (PoS) algorithm with its native token, SUI. Its core mission is to serve as a platform for developers to create web solutions—from gaming to DeFi services—capable of handling millions of users daily without transaction delays. The platform is crafted around Move, an open-source programming language initially developed at Facebook for the Diem blockchain (formerly known as Libra), which has been discontinued due to regulatory pushback in the U.S.

Sui Blockchain: Distinguishing Features and Fast Transactions

Sui claims to outperform all other blockchains with a capacity for 120,000 transactions per second, catering especially to real-time applications like gaming. It optimizes transactions to be idempotent, preventing the duplication issues often exploited by hackers.

Sui uniquely processes each transaction individually, not in traditional blocks, enabling faster confirmations and reduced delays during peak loads. Transactions mainly require the user’s account information, focusing on locking specific data rather than the entire transaction chain.

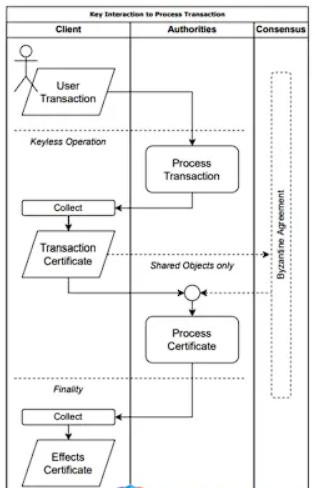

Sui’s Transaction Process:

- Transactions are broadcast to all Sui validators.

- Validators vote to confirm or deny based on Proof-of-Stake rules.

- A Byzantine fault-tolerant certificate is created from the votes, ensuring the transaction’s permanence.

- Senders can access this certificate to see detailed transaction results.

High Performance

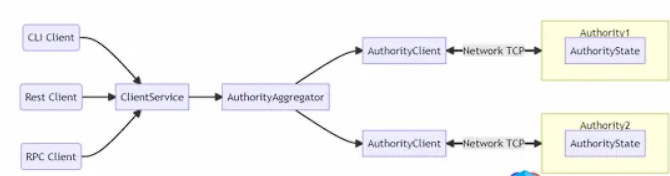

Sui stands out for its high transaction speeds by selectively ordering transactions, allowing for parallel processing. This enables faster transaction execution and lets validators utilize all CPU cores effectively, simplifying validator interaction and reducing code complexity. Unlike many other projects, Sui offloads much of the workload to its Sui Gateway service, keeping the network responsive without constantly checking for transaction status.

Stable Performance in Failures

Sui’s protocol handles simple transactions without designating a leader among validators, minimizing the impact of any single validator failure. This contrasts with many traditional blockchains that depend on network leadership, where the failure of even one validator can significantly decrease throughput and increase latency.

Security Perspective

Unlike many traditional blockchains, Sui does not rely on network synchronicity, maintaining key security features even under adverse conditions, such as severe DoS attacks targeting validators. Synchronous blockchains, mostly based on Proof-of-Work, are vulnerable to issues like double-spending and deadlock during attacks.

Blockchain Architecture

Sui is a distributed ledger that stores a set of programmable objects, each with a unique ID, owned by specific addresses. Transactions in Sui involve a set of references to these objects and use existing Move code in the ledger to execute, leading to object updates. This structure supports efficient and secure operations within the blockchain.

How the Sui Network Economy Works

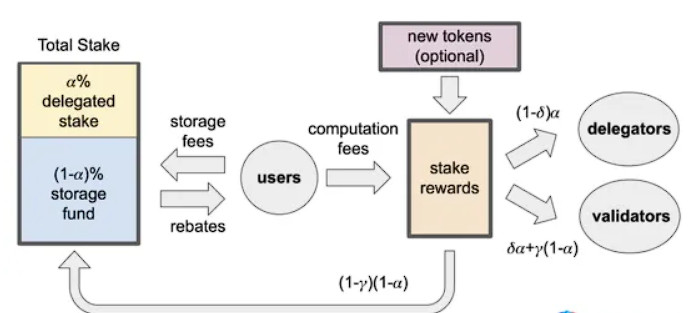

The economy of the Sui network is built on comprehensive research to align with the blockchain’s high standards. The Sui economy comprises five main components:

- SUI Token: This is the primary asset within the network. It is used for gas fees for sending transactions and also serves as a reward for validators.

- Transaction Fees: When users perform transactions, they not only pay transaction fees but also a storage fee for blockchain data storage. These storage fees contribute to a storage fund, which is eventually distributed among validators based on their stake. This scheme is designed to ensure sustainable business models for future Sui validators.

- Proof-of-Stake Algorithm: This plays a crucial role in the network’s economy. It is used to incentivize and reward both validators and delegators within the Sui network.

- Storage Fee Scheme: This unique feature of Sui involves users paying for the ongoing storage of data on the blockchain. The fees collected are pooled into a storage fund, providing a continual source of income for validators, proportional to their contribution and stake.

- On-chain Voting: For governance, protocol updates, and critical decision-making within the network, Sui uses on-chain voting. This involves making decisions through transaction-based voting using the SUI token, ensuring transparency and community involvement in the network’s evolution.

SUI Token Economics and Blockchain Usage

SUI Token Overview: The total supply of SUI tokens is capped at 10 billion. Initially, only a portion of these tokens will be available at network launch, with the rest distributed over several years mainly as rewards for validators. This scarcity is likely to increase demand over the long term, potentially driving up the token’s value. The storage fund mechanism also dynamically reduces the number of SUI in circulation, particularly if the blockchain is widely used for data storage and attracts a substantial user base.

Token Utility

- Staking: Users can stake SUI tokens based on the Proof-of-Stake algorithm to earn rewards.

- Gas Fees: Necessary for transaction processing and data storage on the Sui platform.

- Versatile Asset: SUI serves as a medium of exchange, a unit of account, and a store of value within the Sui ecosystem, facilitated by smart contracts and blockchain compatibility.

- Governance: SUI token holders can vote on protocol updates and other crucial network decisions.

Incentives for Validators: Validators who invest in improving their efficiency and hardware can expect additional rewards and lower gas costs over time. This incentive structure encourages validators to enhance their reliability, benefiting the entire ecosystem. Unreliable validators and their stakers are penalized, promoting trust in more dependable validators.

Blockchain Applications

Sui provides developers with the tools to create innovative solutions, including:

- DeFi and TradFi Services: Enable real-time trading within the network with minimal latency.

- Loyalty Programs: Facilitate large-scale airdrops rewarding millions via fast transactions.

- Complex Gaming: Transparent integration into the network, expanding asset functionalities in games and providing value through token scarcity.

- Asset Tokenization: Offers token-based ownership of everything from real estate to collectibles and medical or educational records, scalable to any size.

- Decentralized Social Networks: Enhances the control over content, posts, likes, maintaining privacy for creators.

Use Case Example

Sui Monstar, a game-simulation prototype developed by GenITeam, involves nurturing pets, feeding them, enhancing with runes, and accessorizing. All in-game assets, including pets, farms, and accessories, are NFTs, showcasing the diverse applications of the Sui blockchain.

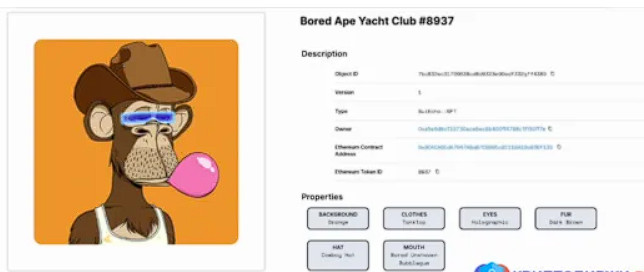

SuiEcho is a service designed for collectors to transfer their NFTs to the Sui blockchain. For instance, an owner of a Bored Ape NFT on Ethereum can recreate and verify its ownership on the Sui blockchain. Once transferred, the NFT becomes an independent asset on Sui, detached from its original blockchain but enhanced with the functionalities of the Sui ecosystem. This feature underscores Sui’s ability to integrate and augment assets across different blockchain platforms, providing added value and utility to existing digital collectibles.

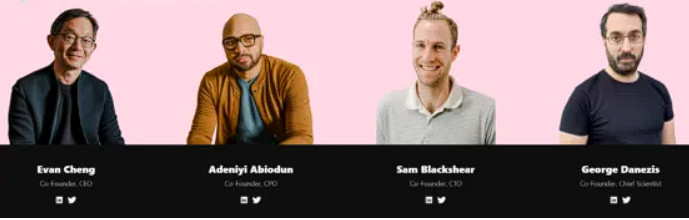

Creation and Development Team of the Project

The project was founded by Mysten Labs, which currently employs 36 staff members. The leading developers of the project previously worked at Facebook on the Diem blockchain and the Move programming language.

Key figures at Mysten Labs and Sui include:

- Evan Chang — CEO.

- Sam Blackshear — CTO.

- Adeniyi Abiodun — COO.

- George Danezis — Chief Scientist.

Creation Story

Mysten Labs was founded in 2021 by a team from Meta’s Novi Research, who spent three years developing high-performance consensus mechanisms and cryptographic proofs. After their stint at Meta, the team established Mysten Labs, aiming to address key challenges in Web3 infrastructure and drive broader blockchain adoption.

Investor Support

Mysten Labs secured $36 million in a Series A funding round led by a16z on December 6, 2021. The round included participation from notable investors like Coinbase Ventures, Lightspeed, and Samsung NEXT, among others. Arianna Simpson of a16z highlighted the market’s demand for efficient smart contract development tools and Mysten’s potential to significantly improve developer experiences in Web3.

User Activities in Sui: Validator Recruitment

Previously, Sui opened registrations for the «Sui Incentivized Testnet,» which concluded on August 15, 2022. During this phase, the Sui Foundation rewarded validators with 2,000 SUI tokens for each testnet phase they participated in, across at least four stages. Moreover, up to 10% of the tokens were set aside for the most effective validators who continued their operations after the mainnet launch. The distribution of SUI rewards was contingent upon participants meeting minimum requirements. These rewards were distributed following the mainnet launch and were subject to a lock-up period of one year. Participation in the testnet required passing KYC through CoinList and being over 18 years old.

For updates on current and future opportunities for user participation or validator recruitment within the Sui network, it’s best to consult the official Sui website or their community channels.

In conclusion

Sui is a transformative force in blockchain technology, emphasizing scalability, fast transactions, and robust support for decentralized applications. Its innovative approach to consensus and validator incentives underscores its potential to significantly impact the Web3 space. As Sui continues to evolve, it offers developers and validators promising opportunities within its dynamic ecosystem, making it a key player to watch in the advancement of blockchain technology.