SEI and SUI are two top 50 altcoins that reached new all-time highs today.

While SUI has increased parabolically, SEI is struggling to close above the previous all-time high resistance area. Will it do so?

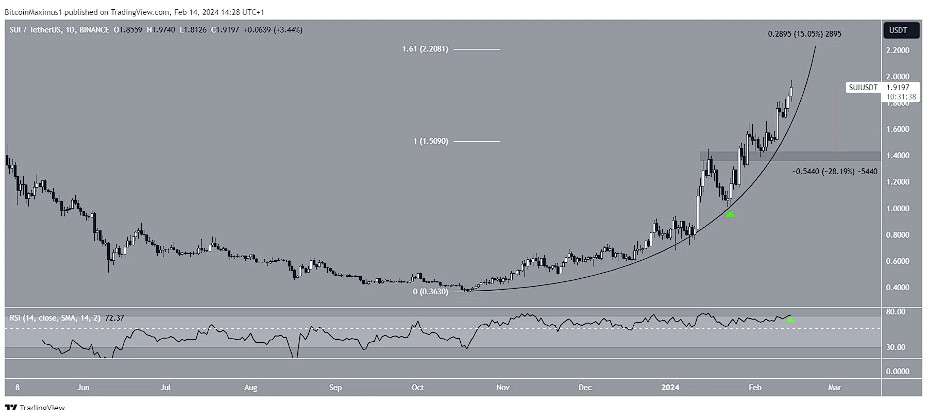

SUI Parabola Leads to New All-Time High

The SUI price has increased alongside a parabolic ascending support trend line since October 2023. The trend line has been validated numerous times, most recently on January 23, 2024 (green icon).

Since then, SUI has accelerated its rate of increase even further. Today, the altcoin reached a new all-time high of $1.97. Furthermore, the Relative Strength Index (RSI) gives a positive reading.

When evaluating market conditions, traders use the RSI as a momentum indicator to determine whether a market is overbought or oversold and whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have the advantage, but if the reading is below 50, the opposite is true. The RSI is above 50 and increasing — both bullish signs.

If the upward trajectory persists, the subsequent resistance level for SUI is positioned 15% higher than its current price, at $2.20. This resistance is formed by the 1.61 external Fibonacci retracement of the preceding decline.

Despite this optimistic forecast for SUI, a departure from its parabolic path could precipitate a 28% fall to the nearest support level at $1.40.

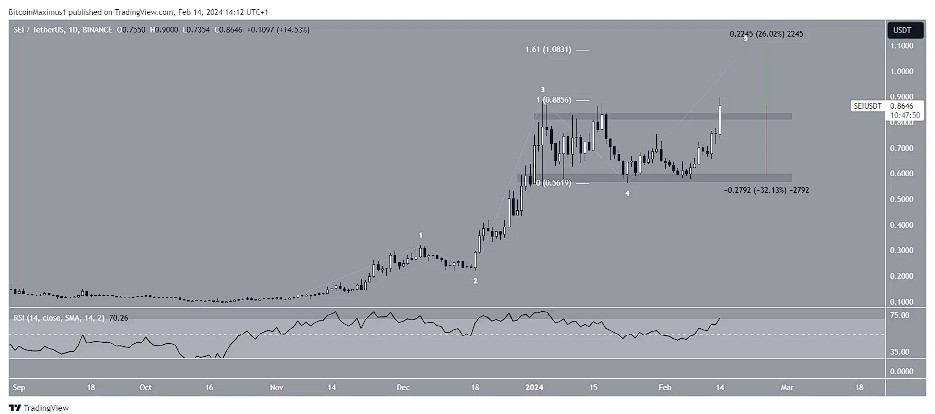

Can SEI Price Surpass Resistance?

The price of SEI has soared since December 2023, culminating in a record high of $0.88 on January 4, 2024. Subsequently, the price retraced, establishing $0.85 as a significant resistance level.

This downward trend halted on January 23. Following the formation of a higher low on February 7, the cryptocurrency experienced a surge, breaking through the $0.85 resistance today to set a new all-time high of $0.90.

The RSI is on the rise, surpassing 70, indicating a bullish trend.

Additionally, the wave pattern supports the continuation of this uptrend. By applying Elliott Wave Theory, analysts can dissect long-term price movements and market sentiment to predict trend directions.

The prevailing analysis suggests SEI is entering the fifth and final wave of its ascent, potentially reaching a peak around $1.08, which is 26% higher than its current price.

Despite the optimistic forecast for SEI’s price, a failure to breach the $0.85 resistance could lead to a 32% decline to the nearest support level at $0.60.