Investors are always on the lookout for profitable ventures in the cryptocurrency market, particularly among altcoins. According to data from The TIE, a leading provider of digital asset information, there are five altcoins that stand out for offering the highest staking rewards.

This is an essential consideration for investors aiming to enhance their holdings by earning passive income from the altcoins in their portfolios.

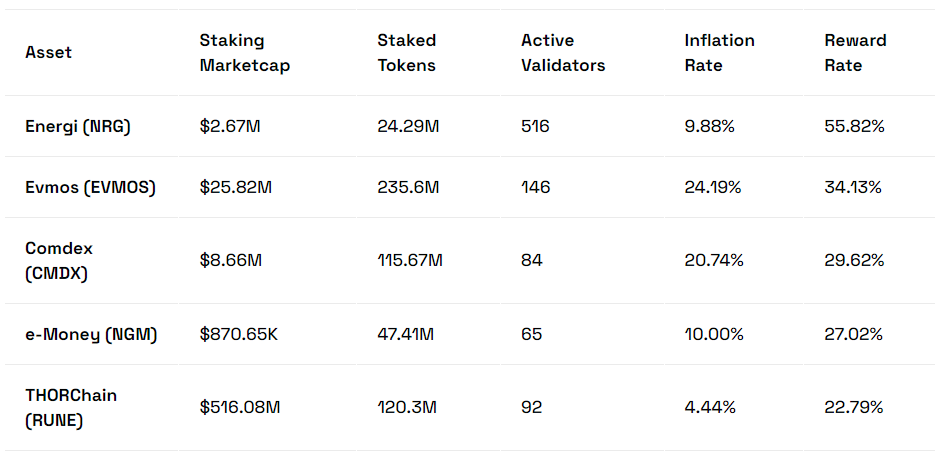

High Yield Generating Altcoins in January

At the forefront is Energi (NRG), with an impressive reward rate of 55.82%. With a staking market capitalization of $2.67 million and 24.9 million tokens staked, Energi offers an attractive option for stakeholders. Its network’s integrity is ensured by 516 active validators, highlighting the system’s security and efficiency. Despite an inflation rate of 9.88%, Energi’s high reward rate continues to draw investor interest.

Evmos (EVMOS) ranks next, offering a reward rate of 34.13%. This altcoin boasts a significant staking market cap of $25.82 million, with 235.6 million tokens staked, and is supported by 145 active validators, reflecting the network’s stability. Investors are advised to consider its high inflation rate of 24.19%, which may affect long-term rewards.

Comdex (CMDX) comes in third with a reward rate of 29.62%, a staking market cap of $8.66 million, and 115.67 million tokens staked. With 84 active validators, Comdex maintains a dependable network, despite a 20.74% inflation rate.

In the fourth slot, e-Money (NGM) showcases a reward rate of 27.02%. Despite its comparatively modest staking market cap of $870,650 and 47.41 million tokens staked, e-Money boasts operational efficiency supported by 65 active validators. Its inflation rate of 10.00% marks it as a solid choice for those aiming to diversify their investment portfolio.

Completing the top five, THORChain (RUNE) provides a reward rate of 22.79%. With a substantial staking market cap of $516.08 million and 120.3 million tokens in play, it stands out as an enticing investment. Governed by 92 active validators and with a reasonable inflation rate of 4.40%, THORChain strikes a fine balance between offering potential rewards and maintaining stability.

List of Altcoins with the Highest Staking Reward

This analysis, based on the most recent data from The TIE, provides insight into the potential of altcoin staking. While the allure of high staking rewards is undeniable, it’s crucial to consider other factors. These factors include network stability, validator activity, and inflation rates, which are essential for making informed and well-rounded investment decisions.

In the past, numerous projects faced challenges in finding a balance between offering high staking rewards and managing inflation. An example of this struggle was observed with PancakeSwap (CAKE) holders, where token inflation posed significant concerns.

“Please stop high rates of reward in staking. This type of APR is similar to Ponzi and scam projects, however, I know PancakeSwap is a very good dex and project. 60% of the reward is a joke, stop it,” community members noted.

In response to these concerns, the PancakeSwap team took action to address the tokenomics. In December 2023, they implemented changes aimed at reducing the maximum token supply by 40%. This move was a strategic effort to mitigate inflationary pressures and ensure the project’s long-term sustainability.