Analysts at the research and brokerage firm Bernstein predict that bitcoin will resume its bullish trajectory after the halving, maintaining their target of $150,000 by the end of 2025.

Gautam Chhugani and Mahika Sapra noted in a client memo on Wednesday, «We expect bitcoin’s bullish trajectory to resume post-halving, when the mining hash rates have adjusted and ETF inflows resume (negative to flat flows last 10 days). Further, integration of spot bitcoin ETFs with wirehouses and RIAs will continue to provide structural demand for bitcoin, in our view. We continue to expect bitcoin to touch a cycle high of $150,000 by 2025.”

This perspective aligns with that of Bloomberg ETF analyst Eric Balchunas, who stated last month to The Block that making the spot bitcoin exchange-traded funds accessible on significant wirehouse platforms—handling between $7 trillion and $10 trillion in assets—was “like putting a product on the shelf of Whole Foods or a big food store. Just that kind of exposure and availability is only going to help.”

Balchunas anticipates the spot bitcoin ETFs to be available on these platforms in the coming months and sees options trading for the ETFs as another significant catalyst.

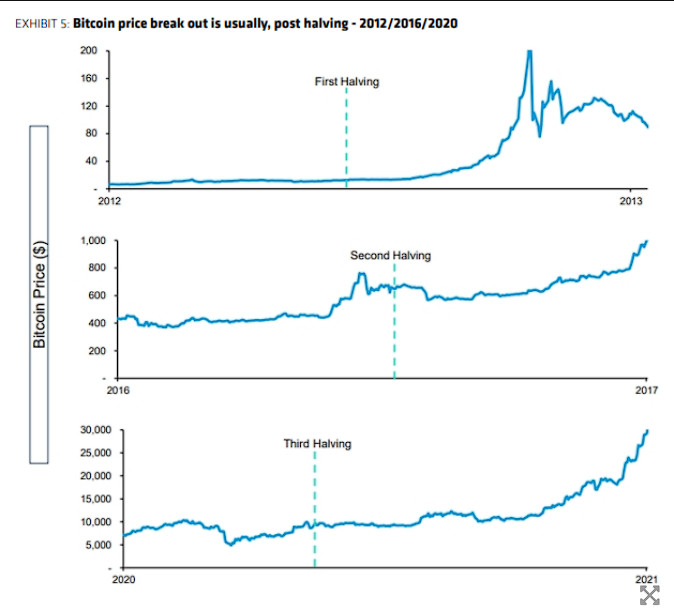

The impact of halvings on price

Historically, Bitcoin halvings have been linked to significant price fluctuations in the cryptocurrency’s market. While there is no direct cause-and-effect, these events have typically preceded major bull runs in bitcoin.

Bernstein analysts highlighted that halving does not automatically increase bitcoin prices without new demand. While miners earn less bitcoin post-halving, reducing potential market supply, this decrease is minor—around 0.12% of daily bitcoin trading volume at today’s prices, making it an insignificant factor for price growth.

According to Chhugani and Sapra, new demand catalysts are key to bitcoin’s price appreciation each cycle. For instance, the post-pandemic demand surge and corporate investments from companies like Tesla, Square, and MicroStrategy boosted prices in the 2020/21 cycle. Recently, spot bitcoin ETF approvals and interest from major asset managers have been driving demand in the current cycle.

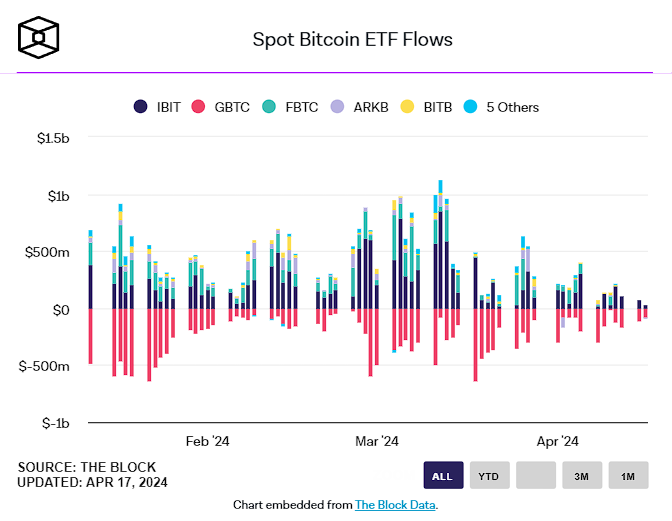

Despite historical trends of price increases post-halving, the 2024 cycle saw an early price rise due to ETF approvals in January, with bitcoin appreciating 50% pre-halving and reaching new highs. However, a 15% drop occurred in the last 10 days amid slower ETF inflows and significant selling of GBTC.

Currently, inflows into spot bitcoin ETFs have slowed since reaching a daily peak of $1.05 billion on March 12, as bitcoin neared a high of $73,836, based on data from The Block.

Miner Impact

Despite recent downturns in miner stocks—falling 15-20% over the last 30 days without outperforming bitcoin year-to-date—some miners are still achieving all-time high revenues in USD. This financial strength, coupled with low debt, has prepared them well for the halving.

Network Hash Rate

Bernstein anticipates that approximately 7% of the network hash rate will shut down post-halving, affecting less efficient miners and consolidating the industry towards four leading public miners: CleanSpark, Marathon, Riot Platforms, and Cipher Mining. This predicted moderate reduction is offset by higher dollar revenues following the ETF launch, 8-10% of revenues now coming from transaction fees due to renewed interest from developers, and the lack of leverage in this cycle.

However, a significant price drop to $40,000 or below could lead to a sharper decline in hash rate. The analysts believe the likelihood of this scenario is reduced, given the continued strong demand for ETFs ($12 billion actual inflow YTD vs. an estimated $80 billion over 2024-25).

Miner Outlook

Post-halving, given their increased market share and strong revenue streams, Bernstein suggests that the top public miners could outperform bitcoin over the next 12 months.

Bitcoin’s Halving Countdown

The next bitcoin halving is set to occur in less than three days or 374 blocks, potentially on April 20 at about 0:15 a.m. UTC (8:15 p.m. ET on April 19). Halvings, which reduce miner rewards per block by 50%—from 6.25 BTC to 3.125 BTC—are scheduled every 210,000 blocks, or roughly every four years. Despite the reduced subsidy, miners will continue to earn transaction fees per block as usual.