On-chain analytical platform Spot On Chain reveals that crypto whales have channeled $35.11 million in stablecoins into Ethereum (ETH), propelling its price past $3,400.

How Crypto Whales’ Activities Established a Strong Support For ETH Price

A closer look at the transactions reveals a strategic play. Eight crypto wallets, likely under a single entity’s control, deployed $20.86 million in USDT to purchase 6,144 ETH, averaging a price of $3,395.

“Notably, five wallets labeled “Address Group 1” were funded with USDT by wallet 0x065 while those from “Address Group 2” were funded with USDT by wallet 0x8ce. These two funding wallets, in turn, had made several transfers in USDT and ETH with one another; thus, likely belong to one entity,” Spot on Chain explained.

Moreover, another significant trade involved crypto wallet 0x5e9, which bought 4,178 ETH with $14.245 million in DAI, averaging $3,410 per ETH. This crypto whale previously earned a hefty profit of $7.48 million from trading activities in Ethereum and Wrapped Bitcoin (WBTC).

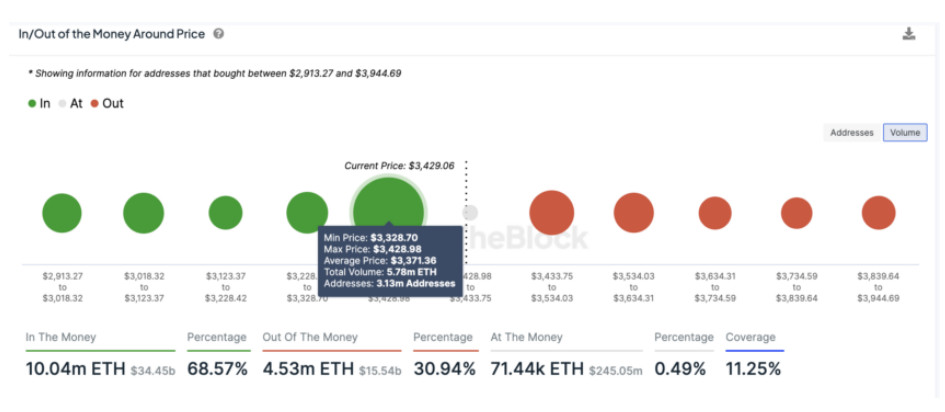

Now, focusing on market trends, the In/Out of the Money Around Price (IOMAP) chart shows Ethereum tightly bracketed by recent crypto whales’ transactions. Consequently, a robust support level has formed between $3,328 and $3,428. Here, about 3.13 million addresses acquired 5.78 million ETH, with an average price of $3,371.

If Ethereum dips below this support, it could face substantial resistance, potentially curtailing its upward momentum. Conversely, above this zone, resistance appears less daunting.

The next significant barrier spans from $3,433 to $3,534. At this level, 2.1 million addresses previously bought 1.6 million ETH, setting an average price of $3,499.

There is a possibility that certain investors may opt to sell at these price levels to offset their investments, potentially triggering a correction in Ethereum’s price. Consequently, these transactions play a crucial role in determining Ethereum’s short-term price direction.

However, according to Hitesh Malviya, the creator of the on-chain analytical platform DYOR, Ethereum appears to have established a local low point.

“After 17 days of re-accumulation period on ETH, the market price is finally moving above the fair price, indicating that we’ve found the local bottom and are ready to go up,” Malviya said.

DYOR asserts that its fair price model assists in estimating the intrinsic value of a token by analyzing supply and demand dynamics. Nonetheless, it is an experimental model and may entail a margin of error.