On April 20, Bitcoin will undergo its much-anticipated halving, a quadrennial event that halves mining rewards, with the upcoming reduction bringing rewards down to 3.125 BTC per block.

The timing of this halving is especially compelling as it occurs during a bullish trend in Bitcoin’s market. Analysts believe this event could significantly shape Bitcoin’s price movement in the forthcoming years.

Is Now the Best Time To Buy Bitcoin?

Bitcoin’s price soared by 67% in the first quarter of 2024, largely fueled by a surge in demand for Bitcoin exchange-traded funds (ETFs). This significant price increase leads to speculation about the halving’s future impact.

Some market experts consider Bitcoin to still be undervalued, predicting a possible rise to $100,000 within the year. The asset’s impressive performance, along with expected rate cuts from the Federal Reserve, supports this optimistic outlook.

Bitcoin is available for purchase on exchanges such as Binance and Bybit, offering investors and traders the opportunity to buy into Bitcoin ahead of the halving event.

A temporary dip might occur, yet with central banks relaxing their monetary policies, we expect an uptick in direct Bitcoin purchases and ETF investments. Bitcoin often mirrors the trends of tech stocks or speculative assets, which usually benefit from such policy adjustments. I project that Bitcoin’s value could surge to between $100,000 and $150,000 within 12 to 18 months following the halving,» Jason Fernandes, co-founder of AdLunam, shared with BeInCrypto.

What is bitcoin halving read in our article: What is bitcoin halving?

On the other hand, some experts argue that the market has already priced in the halving. However, given that Bitcoin’s supply is set to decrease and demand from Bitcoin ETFs continues to grow, many see this moment as an ideal time for Bitcoin investment.

Researchers at NYDIG argue that the Bitcoin halving’s impact on prices might be minimal compared to the effect of ETF demand. As a result, they believe that the roughly 450 BTC in daily supply will not have a substantial impact on prices.

Although the halving event may not act as an instant trigger for price changes, historical patterns indicate its critical influence on Bitcoin’s price cycles. Generally, there’s an anticipation phase before the halving, succeeded by significant gains afterwards. Given the present positive price trends before the halving, investors have grounds for optimism regarding Bitcoin’s future prospects,” wrote NYDIG’s Greg Cipolaro.

However, historical data shows a trend of decreasing percentage growth after each halving. Following the first halving, Bitcoin escalated from $13 to $652, a remarkable 4,802% increase. Later halvings have seen diminishing returns, suggesting we might witness a comparable pattern in the upcoming event.

Fernandes highlighted to BeInCrypto that the impact of Bitcoin’s post-halving performance has varied due to differing macroeconomic events.

The 2012 halving was predominantly engaged by tech enthusiasts and specific communities. By 2016, there was a broader recognition of Bitcoin as a resilient alternative currency amidst economic uncertainties. The 2020 halving occurred during an unprecedented global financial crisis due to the pandemic, making it an anomaly. Overall, the halving’s effects are largely influenced by the macroeconomic conditions at the time,” Fernandes noted.

This detailed analysis underlines a general agreement that, although the direct influence of the halving on BTC’s price might be subject to debate, the event plays a fundamental role in establishing the groundwork for subsequent price trends. Nevertheless, the primary impact is expected on miners’ profitability, especially with rising energy costs.

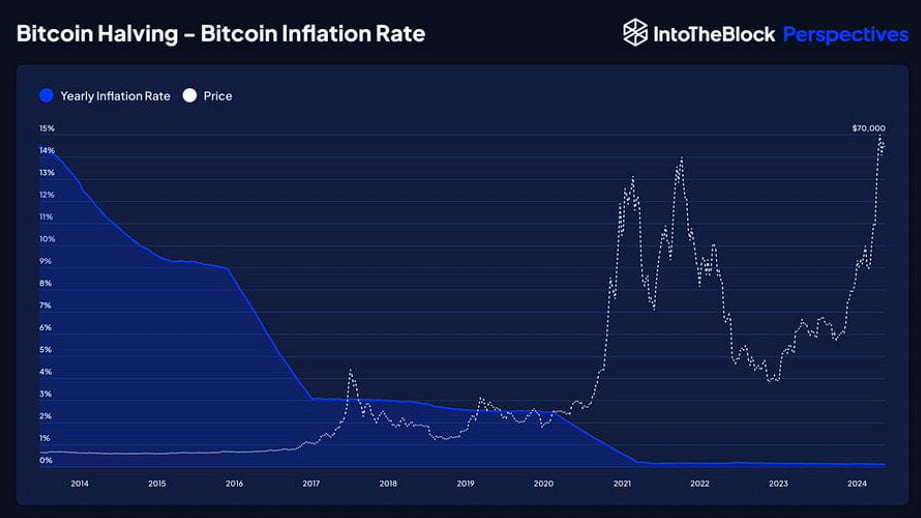

Yet, data from IntoTheBlock shows that miners’ revenue, in USD terms, is currently at its highest, driven by the increasing value of Bitcoin. Should the halving contribute to further price growth, the reduction in rewards might only minimally affect miners’ earnings.