Solana’s (SOL) price is teetering on the edge of a bullish reversal pattern, potentially setting the stage for a recovery rally. This upward movement hinges on sustained market stability and investor recognition of SOL’s current undervaluation.

Potential for Growth in Solana

Currently priced at $139, Solana is exhibiting a descending wedge formation, suggesting an imminent breakout. This trend is supported by the Relative Strength Index (RSI), which measures the velocity and magnitude of price movements and currently indicates bullish momentum.

Additionally, the Moving Average Convergence Divergence (MACD), a tool used to detect changes in the strength, direction, momentum, and duration of a trend in an asset’s price, also reflects a positive outlook. Both indicators, with the RSI positioned in the bullish territory above 50 and the MACD showcasing a sustained bullish crossover, signal potential for Solana to break out of the wedge.

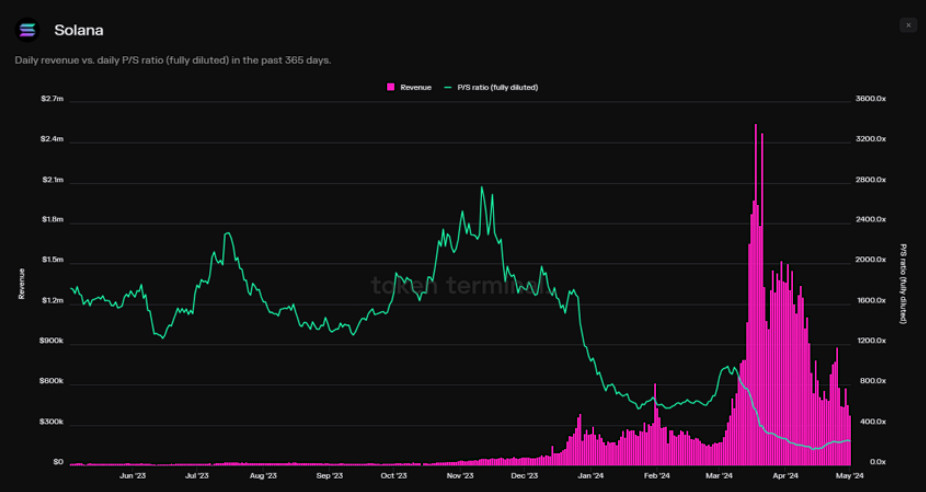

This scenario could potentially lead to a rally, given that the altcoin is currently deemed highly undervalued. This assessment is based on the Price to Sales (P/S) ratio compared to the revenue performance of the asset.

The P/S ratio serves as a benchmark for valuing an asset, where a low ratio may indicate an undervaluation of the stock. Conversely, a ratio exceeding the industry average could point to an overvaluation.

Solana’s revenue has seen significant growth, especially with notable peaks in March. Despite this increase, the P/S ratio remains substantially lower than during periods of lower revenue in Q4 2023.

This suggests that Solana has significant potential for growth moving forward.

SOL Price Prediction: Awaiting a Breakout

Over the last three weeks, Solana’s price has been confined within a falling wedge. During this period, the bullish pattern was confirmed through a sequence of corrections and recoveries.

A falling wedge, characterized by converging trendlines that slope downwards, is recognized as a bullish chart pattern indicating a potential reversal from a downtrend. It generally suggests diminishing selling pressure and the likelihood of upcoming price breakouts to the upside.

Given the factors discussed and with SOL trading just below the upper trend line of the wedge, there’s a strong possibility that the altcoin could soon break out. Such a move would enable Solana to surpass the $142 resistance level and potentially establish $150 as a new support floor.

This significant psychological level has been tested as resistance on several occasions. Historically, a breakout above this level has triggered a rally. Investors can reasonably expect a similar outcome this time as well.

However, if the breakout attempt fails and SOL drops below $134, it could lead to a decline towards $120. If this support level is breached, it would invalidate the bullish thesis and potentially extend the correction down to $110.