Ethereum (ETH) is stuck in a long-term downtrend, bringing the world’s biggest altcoin below $3,000.

However, the presence of investors’ confidence and a potential breakout from a bullish pattern could be key to recovery.

Ethereum Investors Remain Optimistic

Ethereum’s price is already below the $3,000 mark, and any further decline could lead to the altcoin noting a two-month low. However, the chances of this happening are lowered as investors move away from causing further bearishness.

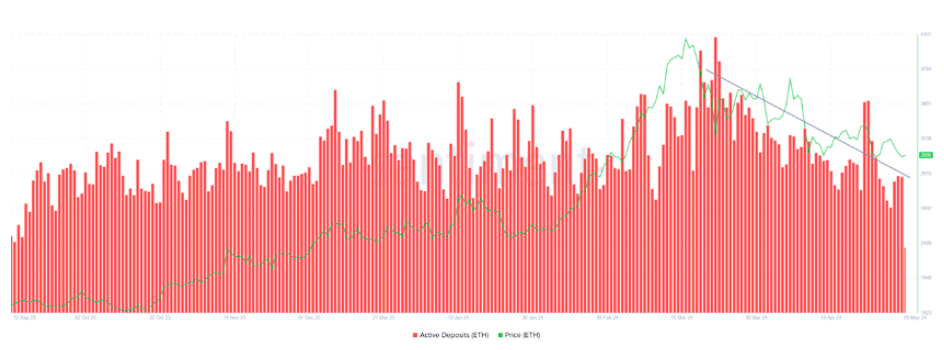

Evidence of this can be seen in their recent behavior, particularly the selling spree that has slowed down over the past few weeks. The active deposits measure the movement of coins into exchange wallets. Generally, a spike in this metric is an indication of potential selling.

In the case of ETH, these deposits have noted a decline, which suggests that the investors are likely moving away from selling. As a result, the altcoin could also witness a slowdown in the price drop.

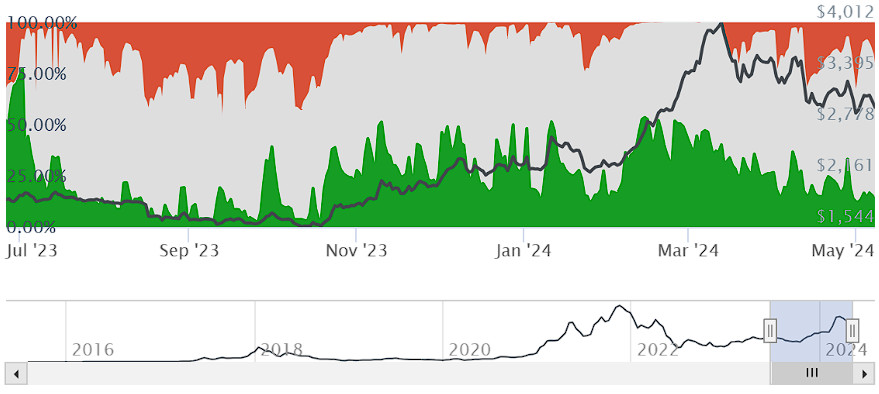

Furthermore, when examining active addresses based on profitability, it’s evident that the dominance of profitable investors has diminished. Their reduced presence indicates a bearish sentiment among ETH holders, signaling a propensity to sell.

However, these profitable investors represent only 15% of all transaction-conducting investors on the network. Conversely, investors experiencing losses have seen a significant 15% increase over the past two months. This highlights a slowdown in selling activity and a growing inclination towards HODLing.

Those in losses anticipate a price rise and are active on the network, indicating conviction and confidence, crucial for driving the potential recovery rally for ETH.

ETH Price Prediction: Escaping the Wedge

Ethereum’s price is currently in a descending wedge and is on the verge of a breakout. This breakout could occur with the support of investors, considering the factors mentioned above.

A descending wedge is a bullish reversal pattern suggesting a potential rally following a breakout above the upper trend line. For ETH, this breakout could result in a 28% rally, pushing the altcoin to $4,000, the pattern’s target.

However, a more realistic outlook would be to reclaim $3,000 and push the price to flip $3,500 into support.

However, if the drawdown persists, Ethereum’s price could drop below the lower trend line at $2,800. This scenario would extend the losses, potentially pushing ETH down to $2,600, which would invalidate the bullish thesis.