The price of Shiba Inu (SHIB) is currently weaving through a complex tapestry of market signals, showcasing a blend of stabilization and impending volatility that is capturing the attention of investors.

Certain indicators are painting a picture of gradual stabilization, sparking a guarded sense of optimism within the investment community. Yet, the landscape is also dotted with signs of emerging technical formations and oscillating investor interest, signaling that the path ahead may be fraught with price fluctuations.

Diminished Network Activity and Its Implications

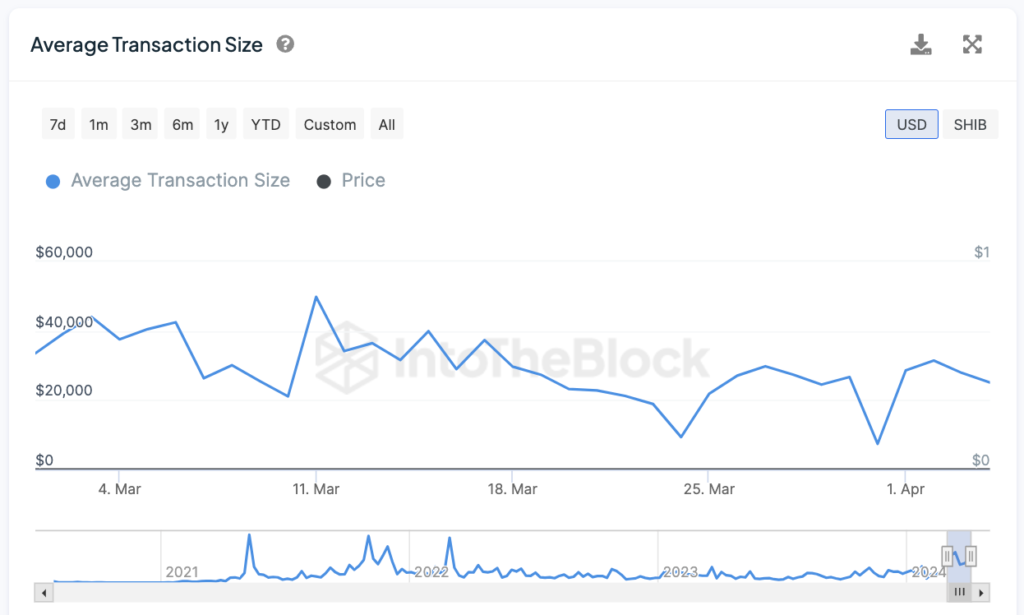

A closer examination of Shiba Inu’s transactional metrics over the past month reveals a trajectory of initial explosive growth that tapers into a steadier rhythm.

The average transaction size saw a drastic fall of 81.23% in less than two weeks, a move that subsequently transitioned into a phase of stabilization. This shift suggests a newfound equilibrium in SHIB’s market activity, potentially steadying its price movements.

RSI Trends and Market Sentiment

The Relative Strength Index (RSI) for SHIB has lingered in the overbought territory but is showing signs of retreat from 90 to 78. Although still indicative of overbought conditions, this decline in RSI points to a waning purchasing momentum, possibly reflecting a broader change in investor sentiment that could usher in a price adjustment phase.

Predictions of Price Movement: Consolidation Versus Correction

While several metrics hint at a consolidation period for SHIB, the emergence of a ‘death cross’ in its technical analysis suggests a possible bearish downturn. This indicator could be a harbinger of forthcoming price corrections, potentially dragging SHIB down to the $0.000019 mark.

Conversely, should SHIB successfully navigate past the current resistance level of $0.000034, there’s a potential for a bullish surge towards $0.000040, marking a significant 50% increase from its present valuation.

As the Shiba Inu token continues to tread through this intricate market landscape, investors remain poised on the edge of their seats, eagerly watching for the next pivotal movement that could define the token’s trajectory in the near future.