Solana (SOL)‘s value is presently in the spotlight, as a combination of technical indicators and trends in network activity stir debate over its forthcoming trajectory.

With a rise in DEX trades and a complex technical environment, SOL stands at a pivotal juncture.

Challenges and Operational Efficiency in Solana

Solana’s rise as a preferred blockchain for emerging Solana-based meme coins triggered an increase in network activity, accompanied by certain complications. Recent times have witnessed a surge in failed transactions, raising alarms among both users and developers.

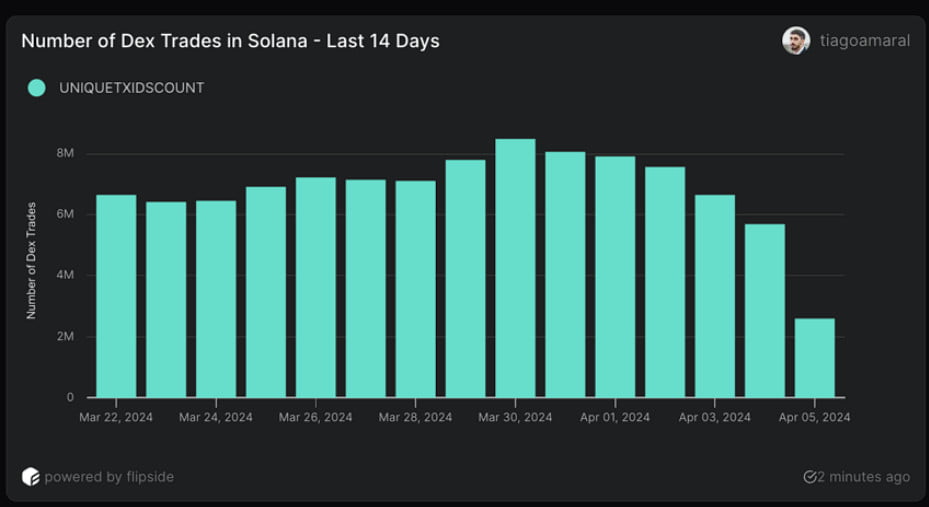

Even though DEX transactions hit a high of 8.5 million on March 30, there has been a decline to 5.6 million by April 4. This drop suggests potential operational constraints and escalating dissatisfaction among users.

Furthermore, the Average Directional Index (ADX) for Solana reveals a critical perspective on its price movement. Currently at 36, it signifies a robust bearish trend.

The escalation from a value of 9 to 36 in a short timeframe emphasizes the intensifying force of the downtrend, likely preparing the path for additional decreases in price.

SOL Price Forecast: Is a Return to $137 Possible?

Solana’s price finds itself at a critical crossroads. The latest technical indicators, marked by a death cross, along with reduced DEX trading volumes and a strong ADX signal, depict a downward trend.

Should this trend persist, SOL might challenge its $167 support, with a possible decline to $137 on the horizon, particularly if ongoing operational challenges erode investor trust further.

However, should Solana manage to effectively address these operational challenges, there is a chance for a reversal in fortunes. A successful resolution could pave the way for Solana price to challenge higher resistance levels. Therefore, it could potentially aim for $205 or even $210, as market sentiment improves.