The competition between Ethereum (ETH) and Bitcoin (BTC) continues to captivate traders and investors as they navigate the complex movements of the crypto market.

Recent analyses highlight an ongoing battle for dominance between Ethereum and Bitcoin in the upcoming month. Will ETH manage to restore its bullish trend against BTC in May?

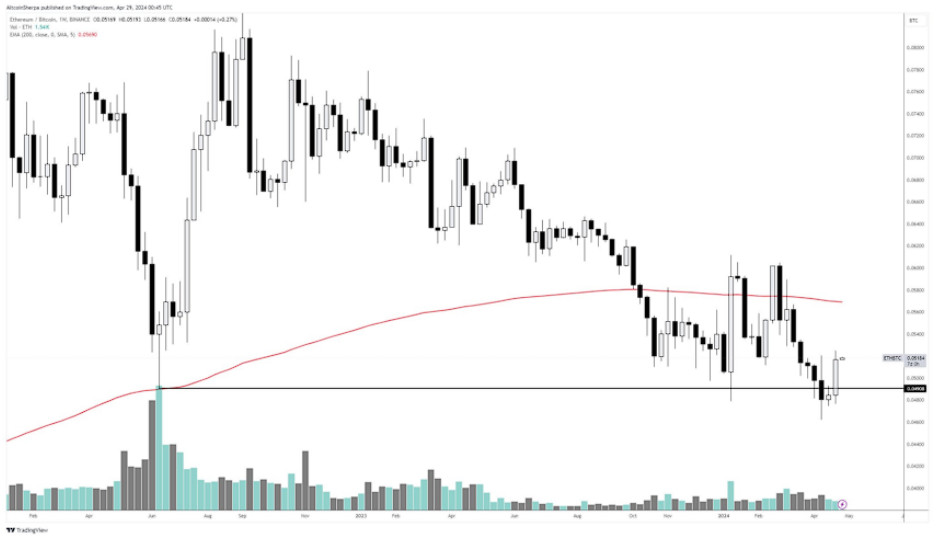

Exploring ETH/BTC: Traders Share Their Perspectives on Cryptocurrency Price Movements Ethereum has recently regained a crucial trading level, showing robust support around 0.049 in its pair with Bitcoin (ETH/BTC). This rebound is crucial as it demonstrates Ethereum’s resilience and potential for further gains if it stays above this key level. According to crypto trader DaanCrypto, ETH continues to trade within a defined range against BTC.

«Besides that, I’m keeping things simple,» DaanCrypto added.

Analysts closely monitor these levels, indicating that simplicity in trading strategies may be the most effective method.

In contrast, the outlook for Bitcoin’s current path is less certain. Observers such as AltcoinSherpa express doubts about a firm reversal, suggesting that although there might be some short-term gains, it’s too early to confirm a definitive bottom.

“I think that we see a bit more upside in the short term but not banking on this being the ‘bottom’ quite yet,” Altcoin Sherpa remarked.

This cautious approach is mirrored by others who highlight Ethereum’s notable volatility and trading volume as potential advantages over Bitcoin’s relatively lackluster recent performance in the market.

Adding to Ethereum’s story are the speculations about regulatory influences, especially the discussions concerning the SEC’s impact on market dynamics. Ethereum’s ability to leverage these regulatory outcomes—be it through ETF rejections or approvals—could significantly benefit its price due to the resulting trading volatility.

Anbessa shared insights on how an ETH ETF approval or rejection might be the key driver for future developments.

“Does the SEC try to shake you out before the reversal?” Anbessa questioned.

Moreover, the trader noted that although the downside target on ETH/BTC has been reached, it might retest support before witnessing further upside.

“We could still see another retest of support and consolidate for a few months. Solid volatility to profit from ETF denial and later approval insider trading before it gets sent. SL unchanged,” Anbessa concluded.

ETH/USD Pair Also Showing Lack of Bullish Momentum

However, not all indicators are bullish. Observations from market analysts like ColdBloodShill note that Ethereum has had difficulty in establishing a firm foothold in recent months, encountering obstacles in maintaining a steady upward trajectory. These insights are vital as they highlight the continuous challenges and the competitive edge needed to truly surpass Bitcoin.

ColdBloodShill’s chart illustrates how ETH has failed to maintain key support levels, effectively converting them back into resistance. The chart also suggests a potential for further declines to the $3,100 area.

While Ethereum displays promising indications that it might outperform Bitcoin in May, the inherent unpredictability of the crypto market ensures that outcomes remain uncertain.

The contest between Ethereum and Bitcoin extends beyond just prices and technical analysis; it also encompasses how broader market dynamics, including regulatory developments and economic indicators, impact these two leading cryptocurrencies.